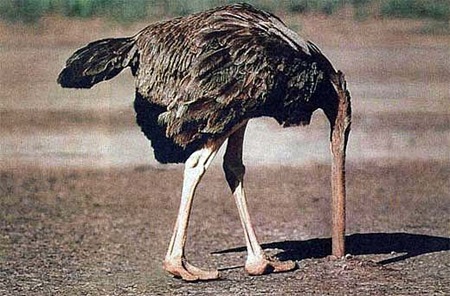

Nothing makes me happier than getting ignorant emails asking me to take my blog posts down. It’s your choice to be ignorant, if everything is OK and you’re determined there is nothing wrong out there, just stick your head in the sand and let the rest of us that have businesses to run, employees to pay, customers to be responsible to and generally aware of the business ecosystem do our jobs.

To those of you without sand in the ears, curious as to what the problem was:

NEW YORK (AP) — Just four days after Bear Stearns Chief Executive Alan Schwartz assured Wall Street that his company was not in trouble, he was forced on Sunday to sell the investment bank to competitor JPMorgan Chase for a bargain-basement price of $2 a share, or $236.2 million.

“The past week has been an incredibly difficult time for Bear Stearns,” Schwartz said in a statement. “This represents the best outcome for all of our constituencies based upon the current circumstances.“

So let’s recap. Monday, everything fine. Tuesday, everything fine. Wednesday, things are going great! Thursday, we’re good. Friday, A-ok. Saturday, market closed. Sunday, sell the company for $2/share, effectively a bankruptcy, potential loss of 15,000 jobs.

What happened on Saturday? Did they get a $39 late charge fee on their Visa bill and they couldn’t cover it? Someone mug the CEO who just happened to have 16 billion dollars in assets on him at the time? Did the repo man come over and take their fridge so they don’t want people in the office? What happened?

What happened is that there was a whole lot of lying going on about how screwed some of these banks are and the weight of the bag of insolvent debt they are dragging. All these banks, including the President of United States of America, are collectively staring straight at the camera and lying to everyone about how deep in trouble we are in hoping we don’t catch on to the fact that behind the scenes they are buying each other for $2 and the fake monetary system is used to move around fictional money not based on a gold standard from one empty bucket to another.

There is a difference between denial and outright lying. Denial is saying that we’re not in a recession. Saying that everything is OK and then bankrupting the company four days later while admitting that “this past week has been an incredibly difficult time” is lying.

Bonus Round

The blog post is not going down but I have a business question for you to answer:

Assume that all financial, lending, credit and borrowing systems are connected, worldwide. [Check] Assume that the companies that manage/run/operate those companies are now filing bankruptcies or selling for $2/share which is below the market value of even their headquarters. [Check] Assume credit is almost impossible to obtain. [Check] Loss of jobs [Check] Loss of value in your home that is impossible to liquidate under current circumstances [Check] Loss of 401K, mutual funds, real estate and other investments [Check] Increase in energy costs [Check] Political uncertainty [Check]

You run an IT Solution Provider business that grows as the current customers grow or new businesses get started. If the current businesses are downsizing and there is no new business, how does your company grow? (one man shops substitute “salary” for “company”)

How is that for starting a debate?

Now let’s make it nasty. Your possible answers are:

A. There is no recession, business is up and will always continue to go up so long as we make minor adjustments to our course as we go along. (This is remarkably similar to the stance the CEO of Bear Sterns took, look above, right before the giant wave of reality destroyed his business a few short days later.) If you picked this answer you are a fucking moron, let me save you some time and point you straight to the form.

B. Sell the customers Windows Server 2008, Windows Small Business Server 2008, Windows Essential Business Server 2008 and show how an investment in new infrastructure will reduce operating costs and make the business more productive while realizing savings. You are still an idiot, albeit an enterprising one, I would like to offer you a 100% commissioned sales job at Own Web Now.

C. Sell the customers managed services, which cost far less than the internal IT employee salary for keeping the company technology infrastructure together. (Hope they don’t read the fine print at the bottom of the contract where it says you will only manage their infrastructure after it’s brought “up to spec” meaning a massive upgrade and redesign of a network glued together by someone that spent four days of the workweek on a torrent site trying to leech down the new cracked version of Vista activation server.)

D. None of the above.

So what is the solution? Well, planning, for one.

Dreams, hallucinations and denial? Not so much.

Listen, these aren’t girl scout cookie stands disappearing. These are the biggest banks in the world, folding under the pressure of insurmountable and unpayable debt, generated by the economic indulgence that likely fueled the growth of businesses that you have grown your own enterprise on top of. We aren’t losing a farm, an economic sector, a state or even a really big building – we are losing the very top of our financial world which fuels everything we do and in turn makes it possible. The very top is crumbling, admitting that it cannot live up to its obligations, admitting that things are bad, wasting jobs, financial portfolios, tanking property values, soaring energy costs… This isn’t some highrise getting blown up (WTC), a company wiped out by criminal activity of its management (Enron), a town flooded (New Orleans) or a bad roll of dice in Las Vegas.

I beg you, please start thinking about it! This does, or rather soon will, affect you.

For the less coherent, more grammatically correct realtime insight, follow me on Twitter at

For the less coherent, more grammatically correct realtime insight, follow me on Twitter at

Pingback: Inflation Report, Bad, Very Bad « SMB Thoughts by Brian Williams